Create a free profile to get unlimited access to exclusive videos, sweepstakes, and more!

Rich People Should All Get Prenups (and It Doesn't Really Matter for the Rest of Us)

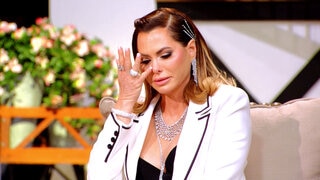

The Real Housewives of Dallas mom Kary Brittingham loves making her own money, even if she has a prenup.

When I say "Real Housewife," you say prenup. The two go together like peanut butter and jelly.

The Real Housewives of Dallas ladies recently had their own honest conversation about prenups: who has one, who doesn't, who has their own money, and who doesn't. (Check it out in the video above.)

Signing off on a marriage with a contract seems like the norm for most wealthy couples — and it is. We've all heard of marriages that go down in flames with no prenup in place, leaving one person with half of what they entered the marriage with. So, Personal Space asked Los Angeles-based divorce attorney Christopher Melcher, founding partner of Walzer Melcher family law firm, to give us the ins and outs of prenups.

Prenup 101: Who needs one?

“Prenups are mostly for people who either are wealthy or who will be wealthy through inheritance,” Melcher explains. “The second group of people who need them are those who are in a second marriage and they have children in a prior marriage they need to protect. The third group, they’re going to receive a family business and it’s a condition by the parents that they keep the business in the bloodline.”

Melcher says that in the category of the rich or soon-to-be rich, he often sees tension “between the wealthy person’s desire to protect themselves against the partner’s desire to feel like an equal and share in the success of the marriage.”

“Many times these prenups are drafted very bluntly where the wealthy person gets to protect everything and the other spouse gets nothing and that’s just unfair,” Melcher says. “That results in a marriage filled with resentment. A balanced agreement would probably provide protection and provide support and shared property if the relationship ended in divorce.”

"A problem arises when someone gets married and they have kids and they found a new spouse and they don’t do a prenup or a will or trust,” Melcher explains. “That person dies, all their estate could potentially go to the new spouse and children get nothing.

"Without planning that could happen,” he says. “That would be a terrible outcome; we can’t have that happen.”

Who doesn’t need one?

“People who don’t want to spend $10 to $20,000 writing one,” Melcher explains, adding, “That’s the easiest way to articulate it.”

He explains why it’s so expensive to even draw up a prenup:

“Typically a well-written agreement is going to cost at least $5,000 per side, and require both sides to have a lawyer. These are hugely complicated agreements, so the minimum we’re talking is 10 thousand to start.”